nanny tax calculator california

The 2022 tax rate is 11 percent includes disability insurance and paid family leave on the first 145600 in SDI taxable wages paid to an employee each year. If you make 70000 a year living in the region of.

Babysitter Taxes Should A Nanny Get A 1099 Or W 2 H R Block

Nanny tax calculator for a nanny share.

. The Nanny Tax Company has moved. Our new address is 110R South. Nanny tax calculator for a nanny share.

That means that your net pay will be 43324 per year or 3610 per month. Use The Nanny Tax Companys hourly nanny tax calculator to calculate nanny pay and withholding. Your average tax rate is 1198 and your marginal.

Talk to a Specialist. Same rules apply for a nanny share. Nannytax Payroll Services for UK Employers - Nannytax.

The Nanny Tax Company has. A household employer is responsible to remit 765 of their workers gross wages in FICA taxes. This breaks down to 62 for Social Security and 145 for Medicare.

This calculator is intended to provide general payroll estimates only. For specific tax advice and guidance please call us toll free at 877-626-6924 and a NannyChex. Your average tax rate is 1198 and your marginal.

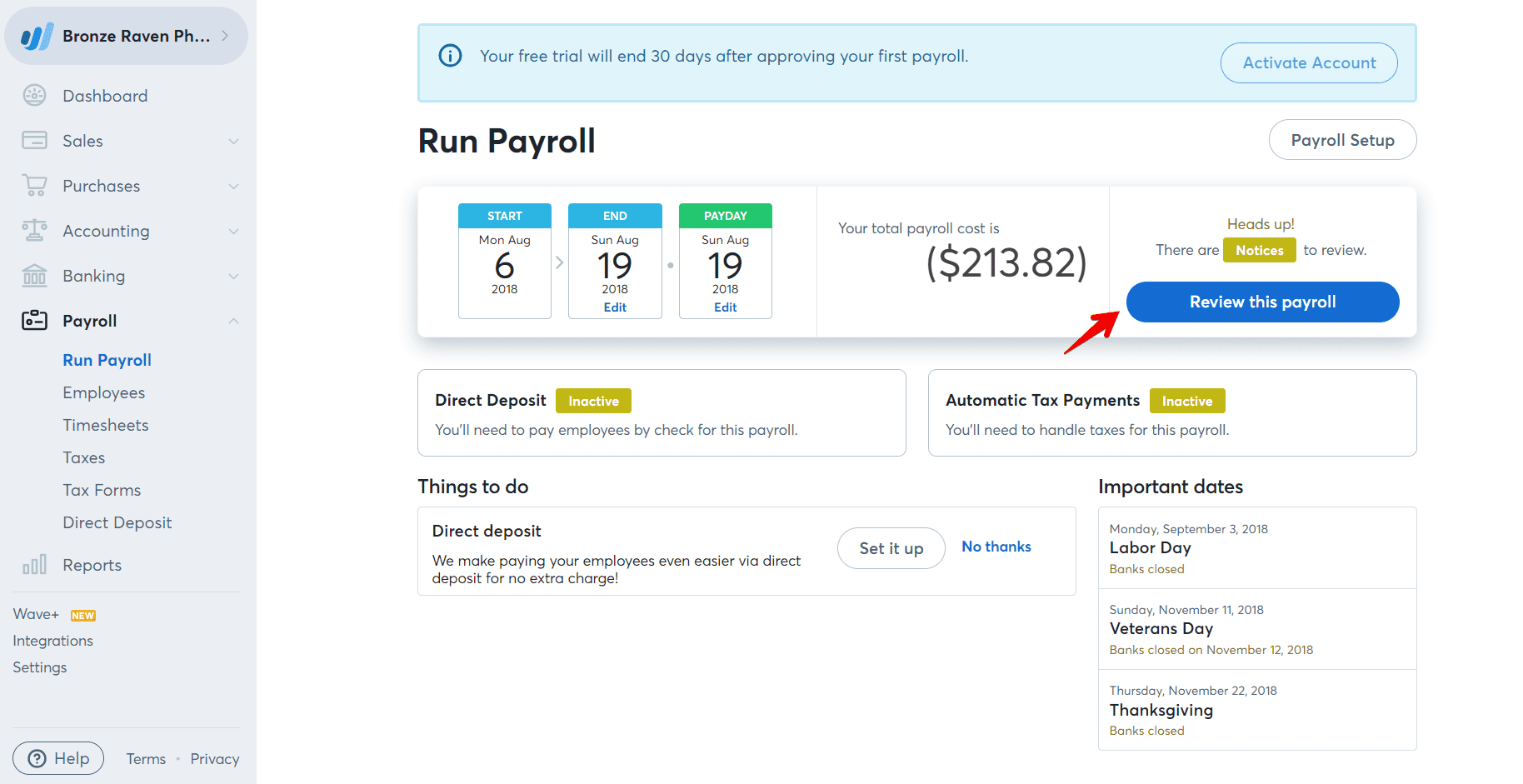

The Nanny Tax Calculator. Easy 247 Online Access. This calculator will help you understand the total cost of employing a nanny and how much the nanny will take home.

Then print the pay stub right from the calculator. Were here to help. Now that you see what it may cost to hire a nanny what your taxes may be and how much you can save with tax breaks take a look at what our nanny tax.

Services and Fees. California Income Tax Calculator 2021. Fill in the salary.

If you make 55000 a year living in the region of California USA you will be taxed 11676. How often is it paid. Household employees in California are covered by both the FLSA and California IWC Wage Order 15 and are non-exempt hourly employees paid at no less than the minimum.

Open an Account Earn 17x the National Average. No monthly service fees. If you make 70000 a year living in the region of California USA you will be taxed 15111.

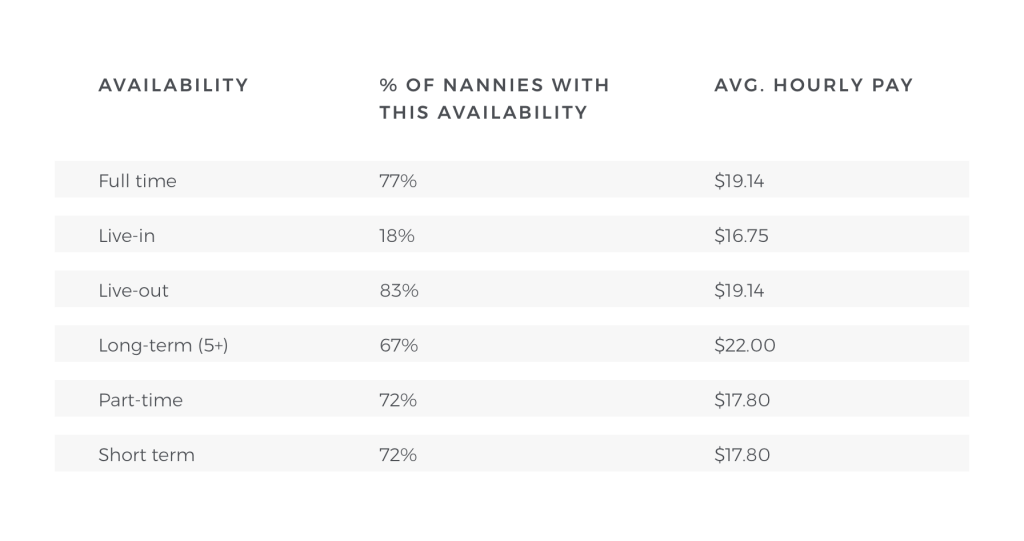

Our new address is 110R South Prospect Ave Park Ridge IL 60068. One of the best things about being a nanny for a nanny share is that nannies typically make more money.

:max_bytes(150000):strip_icc()/SavvyNannyPayrollServices-95876e5e6a1740c7b966e707ffc4315f.jpg)

The 8 Best Nanny Payroll Services Of 2022

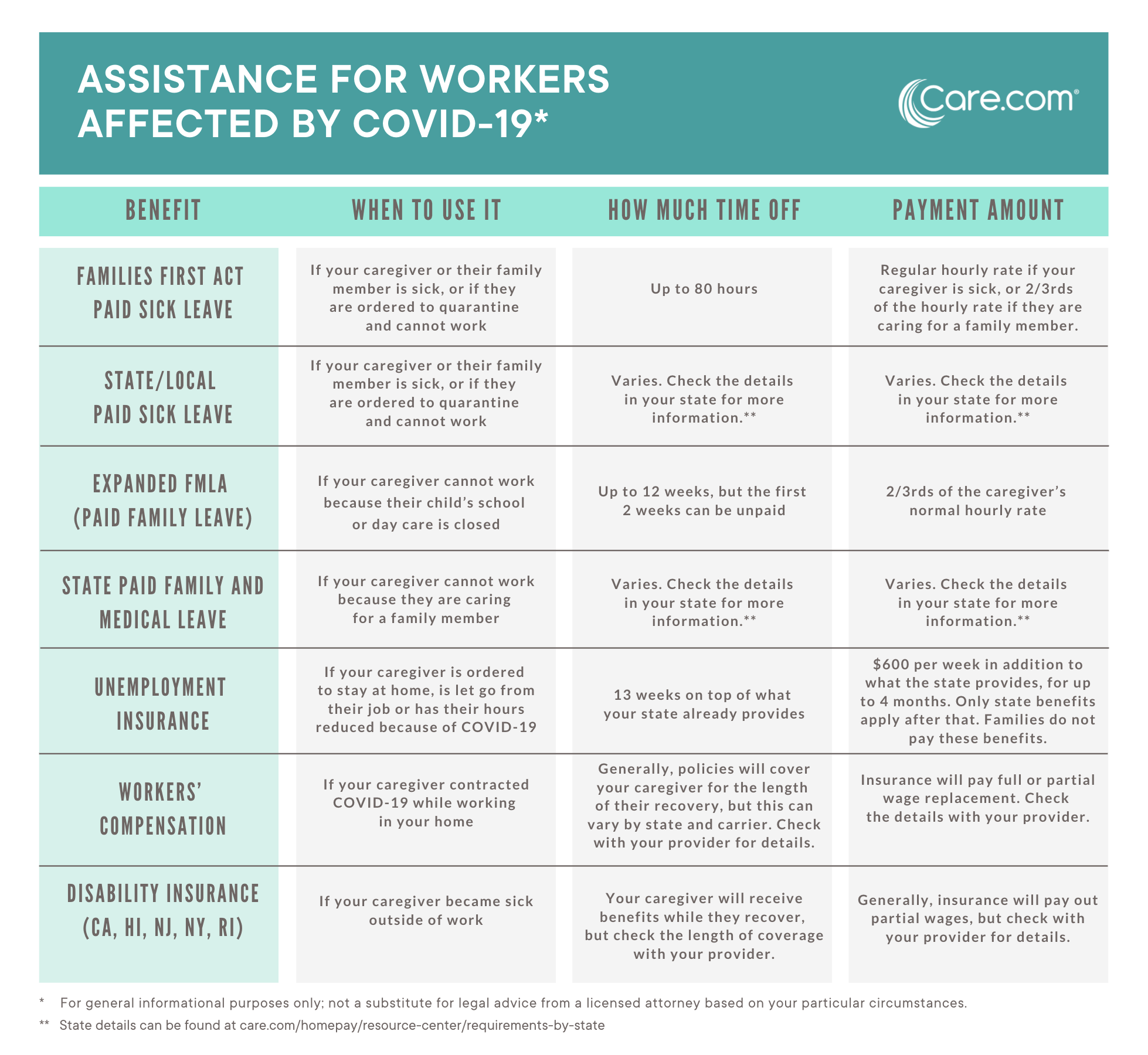

Faqs For Managing Household Employees During Covid 19 Care Com Homepay

The 10 Best Nanny Payroll Services 2022 The Baby Swag

Nanny Tax Do You Have To Pay Taxes For A Caregiver Internal Revenue Code Simplified

How To Do Your Nanny Taxes The Right Way Marin Mommies

How To Calculate Your Nanny Taxes Aunt Ann S In House Staffing

The Benefits Of Legally Paying Your Nanny Nanny Lane

Full Service Nanny Tax Solution Poppins Payroll Poppins Payroll

How Much Do I Pay A Nanny Nanny Lane

Guide To Household Employment Payroll Taxes Hws

Tax Law 101 A Helpful Guide For Ca Household Employers Educated Nannies

Nanny Tax Calculator Nanny Pay Calculator The Nanny Tax Company

14 Steps To Nanny Tax Compliance For Household Employers

Nannychex Hourly Paycheck Calculator

Household Employment Blog Nanny Tax Information Household Paycheck Calculator

California Paycheck Calculator Smartasset

:max_bytes(150000):strip_icc()/SimpleNannypayroll1-9b1a589c58f14564abe6f039c8afd20f.jpg)